Oswald's Proposed Taxes Will Hurt Manitobans

The Canadian Taxpayers Federation (CTF) responded today to NDP leadership candidate Theresa Oswald’s proposed pension taxes with surprise and disappointment at the poorly thought out policy idea.

“Manitobans already pay some of the highest income taxes in Canada and are still reeling from her government’s sales tax increase,” said CTF Prairie Director Colin Craig. “Instead of forcing everyone to pay a new payroll tax, the government should scale back golden employee pensions, cut wasteful spending and use the savings to reduce taxes for everyone.”

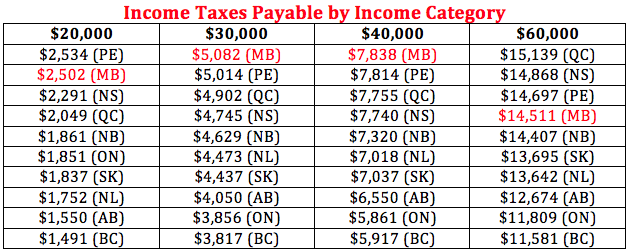

Craig added that Theresa Oswald’s proposal would especially hurt low income Manitobans (eg. $20,000/yr) who are already paying the second-highest income taxes in Canada.

Source: Ernst and Young Income Tax calculator – click here

In terms of the impact on businesses, the CTF noted the idea would be a job killer.

“Many businesses are still having a difficult time with the PST increase, Manitoba’s payroll tax and the province’s high property taxes,” added Craig. “Another tax increase won’t help keep the Cabela’s of the world here.”